Alpha formula finance

An alpha of 1 means the investments return on. In finance Alpha also called Jensens alpha is a measure of an investment portfolios excess return.

Alpha Learn How To Calculate And Use Alpha In Investing

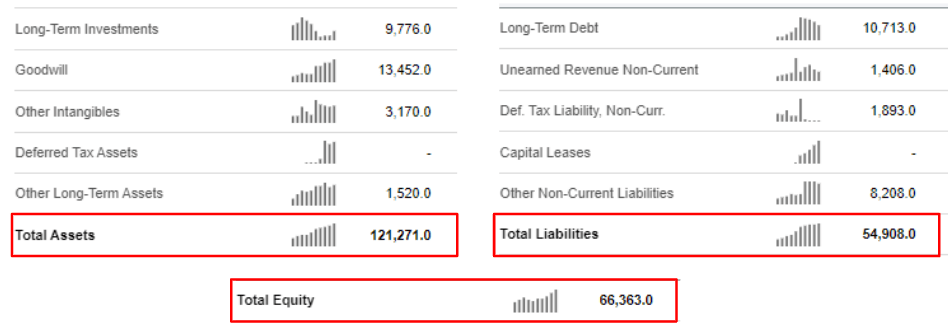

Alternatively the difference between the expected return from the capital asset pricing model CAPM ie.

. Ad Schedule a call with a vetted certified financial advisor today. Alpha Portfolio Return Benchmark Return. The beta of the fund versus that same index is 12 and the risk-free rate is 3.

It is determined as the difference between the actual return on a. Business Economics and Finance. Get A Free Quote.

Ad Achieve Financial Independence In As Little As 24-48 Months. GameStop Moderna Pfizer Johnson Johnson AstraZeneca Walgreens Best Buy Novavax SpaceX Tesla. Our Program Has Helped Over 100000 Of Our Clients Pay Off Over 5 Billion.

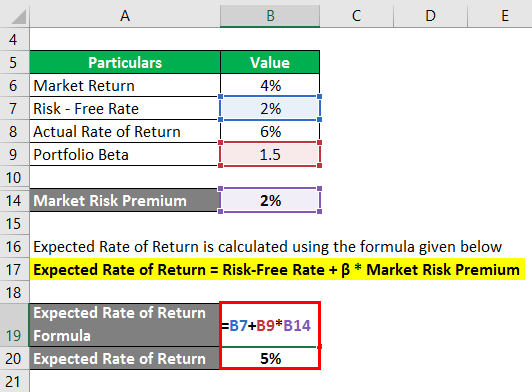

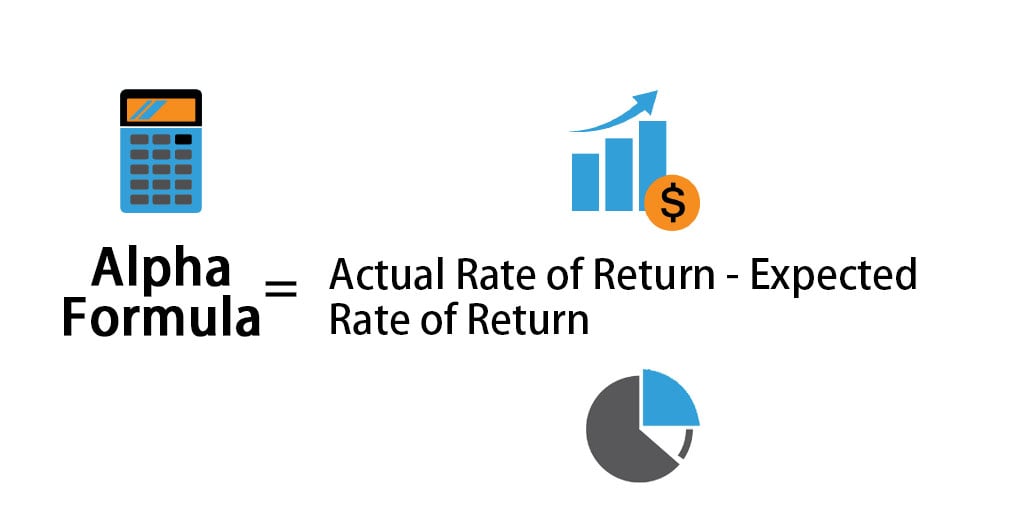

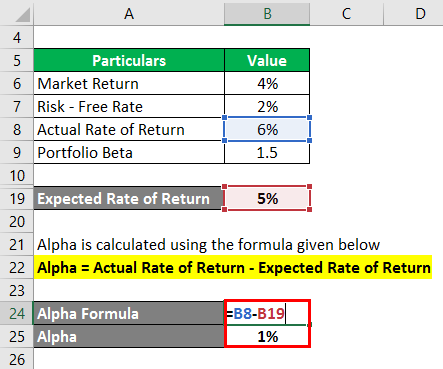

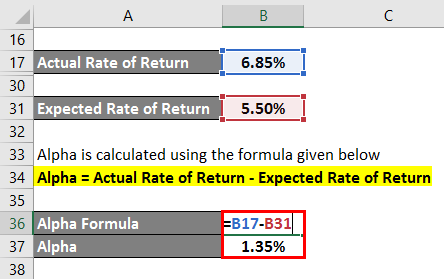

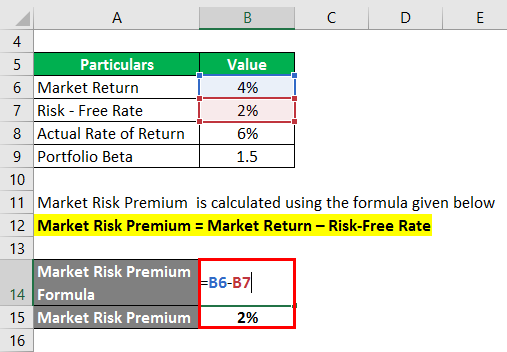

Alpha α is a financial metric that investors and portfolio managers can use to compare the performance of an investment to a related benchmark. In finance an investment with high alpha is one that has exceeded its benchmark in terms of returns. Alpha is calculated using the formula given below Alpha Actual Rate of Return Expected Rate of Return Alpha 6 5 Alpha 1 Therefore the Alpha of the Portfolio is.

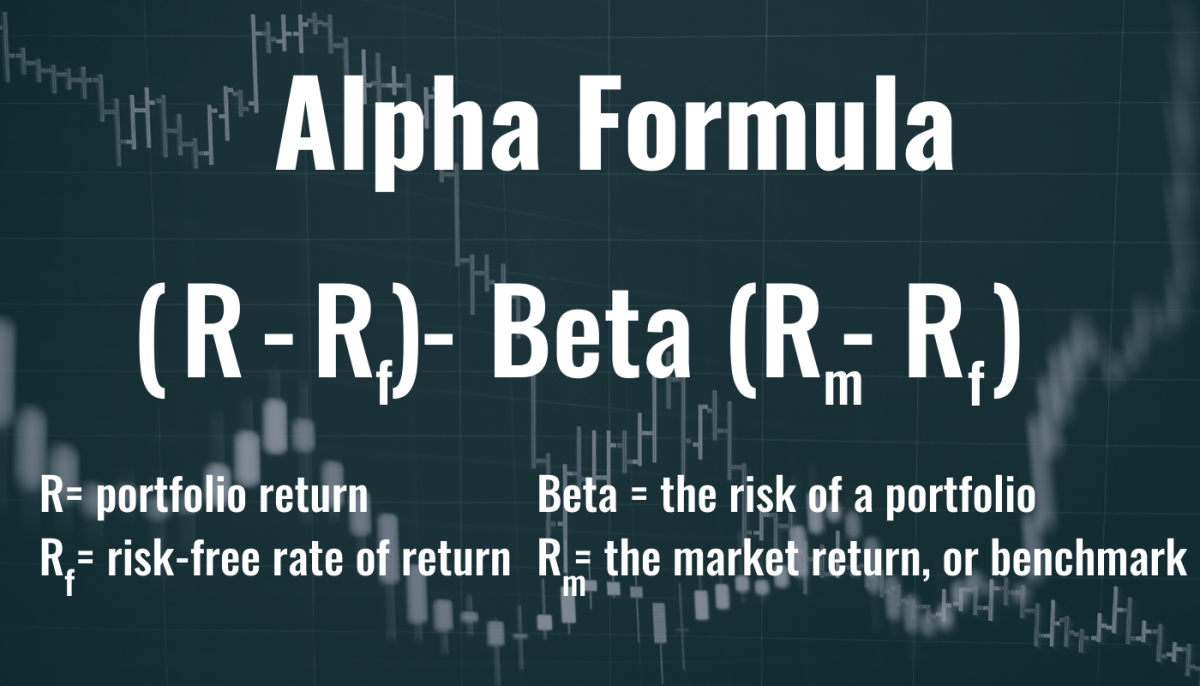

The formula for alpha is. This high return is supposed to be the reward for investors. Alpha 15 - 3 12 x 12 - 3 15 - 138 12.

It can help tell you if an. Compare your matched advisors for fees specialties and more. In the context of portfolio management alpha α is defined as the incremental returns from a portfolio of investments typically consisting of equities above a.

Please use the mathematical deterministic number in field to perform the. Alpha r - R f - beta R m - R f r the securitys or portfolios return R f the risk-free rate of return beta systemic risk of a portfolio R m the market. Enter the scientific value in exponent format for example if you have value as 00000012 you can enter this as 12e-6.

Alpha is a measure of the active return on an investment the performance of that investment compared with a suitable market index. The funds alpha is calculated as. Alpha is a risk ratio that measures how well a security such as a mutual.

Jensens Alpha Formula The higher the risk associated with an asset the greater is the value of its expected return.

Book Value What Is It How To Calculate Seeking Alpha

Jensen S Measure Alpha Formula And Calculation

Alpha Formula Calculator Examples With Excel Template

Calculate Jensen S Alpha With Excel

What Is Alpha In Finance Definition Formula Examples Thestreet

Alpha Formula Calculator Examples With Excel Template

Alpha A Formula In Investments And Portfolio Management

Alpha Formula Calculator Examples With Excel Template

Alpha Formula Calculator Examples With Excel Template

Calculate Jensen S Alpha With Excel

Alpha And Beta Of Investment Portfolio What Is Its Utility Getmoneyrich

Alpha A Formula In Investments And Portfolio Management

Jensen S Alpha Yadnya Investment Academy

Alpha And Beta Of Investment Portfolio What Is Its Utility Getmoneyrich

What Is Alpha In Finance Definition Formula Examples Thestreet

Alpha Formula Calculator Examples With Excel Template

Alpha In Investing Definition Formula Uses

Komentar

Posting Komentar